Why?

So it’s been just over a month now since I made the big change and I’m very glad to say I have no regrets...

So it’s been just over a month now since I made the big change and I’m very glad to say I have no regrets. Over this time I’ve had many meetings with folks to tell them why I made the change but it seems like almost every time I just don’t do justice to all the reasons why I decided that going independent and starting Awaken Wealth Management was the better option for myself, my family, and all those folks that I worked with in the past. So I thought what better place to be able to go a bit deeper and share some of the many reason why I made the leap. I’m not sure how many posts it will take but I really want to do justice to all of the factors that came in to account in making such a, for many, surprising change. Here it goes:

Reason 1: People over Sales

Do you remember Jerry Maguire? The 1996 movie, best remembered for the scene where Tom Cruise yells “Show me the money” to his client on the phone while trying to go through and keep all of his clients as a sports agent that just left the “big firm”. Cruise plays Jerry Maguire who leaves the firm as he believes the system of agents representing the athletes in negotiating contracts and promotions is broken- it focuses on the agents getting paid on the backs of athletes instead of developing relationships and caring for the athletes throughout the careers- doing what is best for them. Well, the system is broken. The focus isn’t where it should be. Instead it’d about growing assets under management and increasing revenues instead of getting people to reach their goals. This is something that’s throughout the industry and is a big reason why I started Awaken Wealth. Instead of focusing on meeting sales quotas and squeezing profit (which I’ve always taken issue with) I can focus on helping my clients reach those financial goals like realizing they don’t need to continue working at a job they hate or that they will be able to take that trip they always wanted to go in retirement.

Reason 2: I’m Different

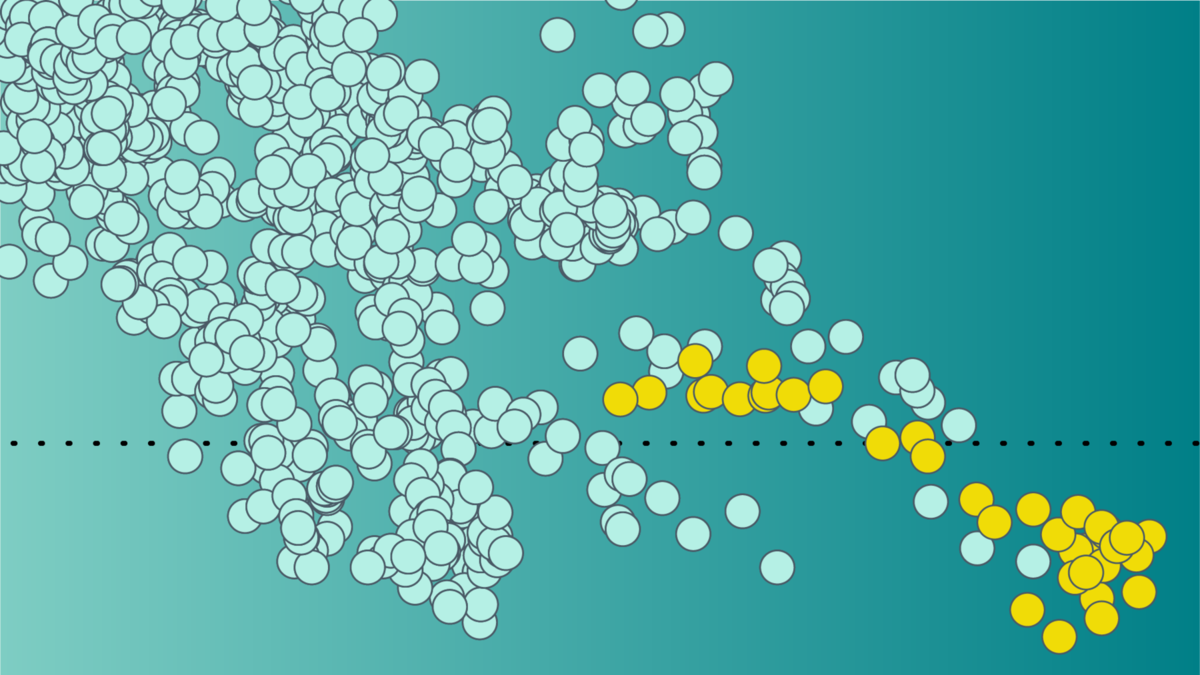

For many years now when I first sit down with someone who is considering working with me and we’re trying to see if there is a “Fit” between us, I’ve often made the statement that I’m different. It’s kind of a weird way to describe yourself without the other person thinking “Of course you are- just like every other advisor out there would say” but it ’s true. The truth is I’m likely different than 95% of the advisors in not only Regina or Saskatchewan but all of Canada as I don’t think paying a manager to pick stocks to beat the market is worth the costs. After many years of being just like just about every other advisor and firm out there in using active managers in client portfolios resulting in continued higher costs, taxes, and underperformance I finally came to the realization that there has to be a better way. That lead me to seek out a better way to invest for my clients. This journey started with scouring many financial books until I finally decided to pick up the book given to many advisors at that time by iShares written by advisor and author Keith Matthews titled “The Empowered Investor” (I found the book of so much value that I bought a box of 100 copies and gifted many copies to people in those first meeting and almost all of my clients). The book described a lot of the issues I saw and spoke to an evidenced based approach- focused on academic research vs Wall Streets sales stories. The book started me down the road of low cost index funds and ETFs, Fama and French, and Dimensional Fund Advisors- a story well worth it’s own post. This all resulted in lower costs to my clients, an investment philosophy based on evidence instead of flavour of the month investment themes, and an overall better investing experience.

Reason 3: Control

All of our lives have been turned upside down over the past year and half throughout Covid-19, some much more than others. Some have been devastated both physically and financially, while many others have thrived during these times- it’s crazy to think how drastically the difference has been. For me one of the big changes was going from being in the office 5 days a week to virtually not needing to step in the office for many months. When everything first started we, like many other business’ closed down the office and it wasn’t until September that we were allowed back in. Even then we were only allowed in every other week AND were not allowed to have clients come to the office. Now there was some flexibility in that if there was no way to meet virtually and everyone masked up and signed waivers and were able to distance and and and… Now in the beginning I was fine with this but as time passed by there was no change- to the day I left I still had an office that was basically an expensive filing cabinet/storage room. After meetings with accountants and lawyers in their offices (some in the same building) while still following all of the health guidelines. The issue with this is that there is a large amount of capital that goes toward renting an office in a downtown building and that decision was out of my control. I had no way of diverting those funds to better uses- like lowering client fees or investing in better technology or support to improve the client experience.

Well, there’s the first three. I could keep going but I know it’s better to share in smaller (is this small?) chunks then writing an essay that parallels “War and Peace”. For those that have heard this already- I hope this helps clarify. What we talked about. For those that haven’t- I’d love to meet for a coffee or jump on a Zoom and chat. It’s as easy as scheduling a meeting here: Coffee Chat

More to come - until then all the best.